Dear Clients of SKJ & Company, P.S.

We are writing to share information on Employee Retention Tax Credit (ERTC) under CARES Act. ERTC provides tax credit to assist qualifying businesses to continue offering jobs. For more details about ERTC program, please refer to the information below. If you would like to be considered for ERTC qualification, please let our office know by email here.

ERTC Qualifications – Your business qualifies for ERTC if you meet one of the following conditions:

If your business was fully or partially closed due to government orders

Example: Restaurants, gyms, religious facilities, etc.

This qualification does not apply if your business is categorized as Essential Businesses.

If your quarterly revenue declined by 50% or more compare to the same quarter of prior year.

Once the revenue recovers 80% under the same comparison, the business disqualifies for ERTC.

ERTC Period

ERTC applies to wages paid between March 12, 2020 and June 30, 2021.

If your business was ordered to close (fully/partially), only the wages paid during the closure qualifies for ERTC.

ERTC Amount

Year 2020

50% of the first qualifying wage paid to each employee.

Qualifying wage is limited to $10,000 per person for the entire 2020.

Thus, maximum ERTC is $5,000 per employee for the entire 2020.

Year 2021

70% of the first qualifying wage paid to each employee.

Qualifying wage is limited to $10,000 per person for each Q1 and Q2 of 2021.

Thus, maximum ERTC is $7,000 per employee per quarter.

NOTE: ERTC Wage limitation applies to the entire year for 2020, but each quarter for 2021.

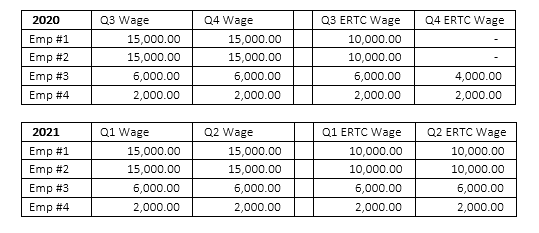

EXAMPLE:

Paycheck Protection Program (PPP) and ERTC

The amount of PPP loan used for payroll is excluded from Qualifying Wages.

How to claim ERTC

ERTC is claimed on Form 941 or Form 944 as a credit against your payroll tax liabilities for the period.

For 2020 ERTC, Form 941-X is filed to claim the credit.

For 2021, ERTC can be claimed on regular Form 941 and Form 944.

Fee for ERTC processing

Our fee for ERTC processing is billed for each quarter the credit is claimed.

The fee is $200 per quarter for which the number of paid employees is 5 or less.

Each additional employee will incur $20.

Please send us a request by email at here. Once all documents are prepared, we will contact you with detailed instructions.

Should you have any questions, please let us know. Thank you.

SKJ & Company, P.S.