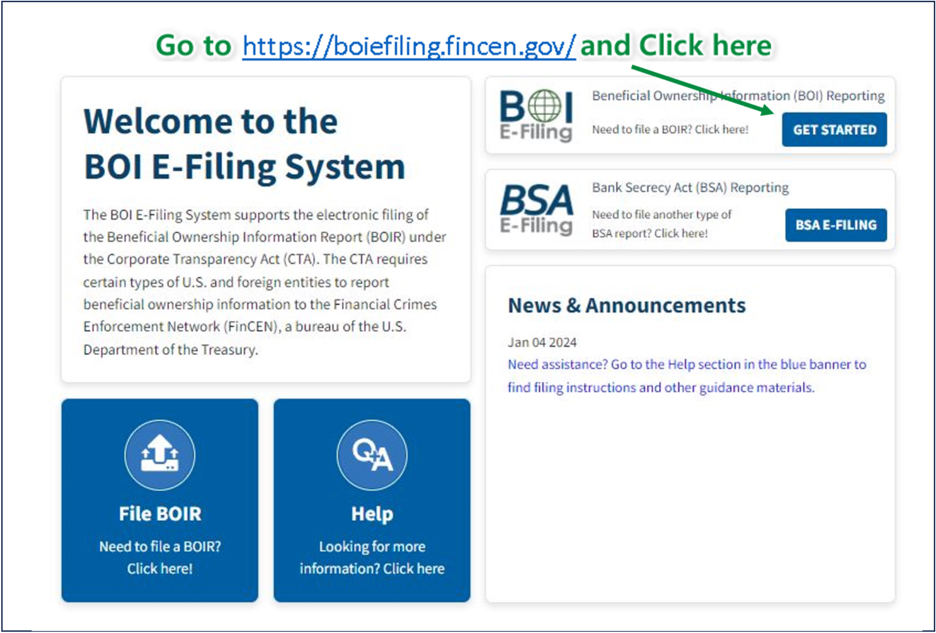

As Congress enacted Corporate Transparency Act of 2021, the Companies in the United States must report the information of their Beneficial Owners to FinCEN under Beneficial Ownership Information Reporting (BOIR) requirements. To help our clients to comply with the new rules, we are providing the brief overview of the reporting requirements and instructions on how to file the BOI report.

Assistance with BOIR filing

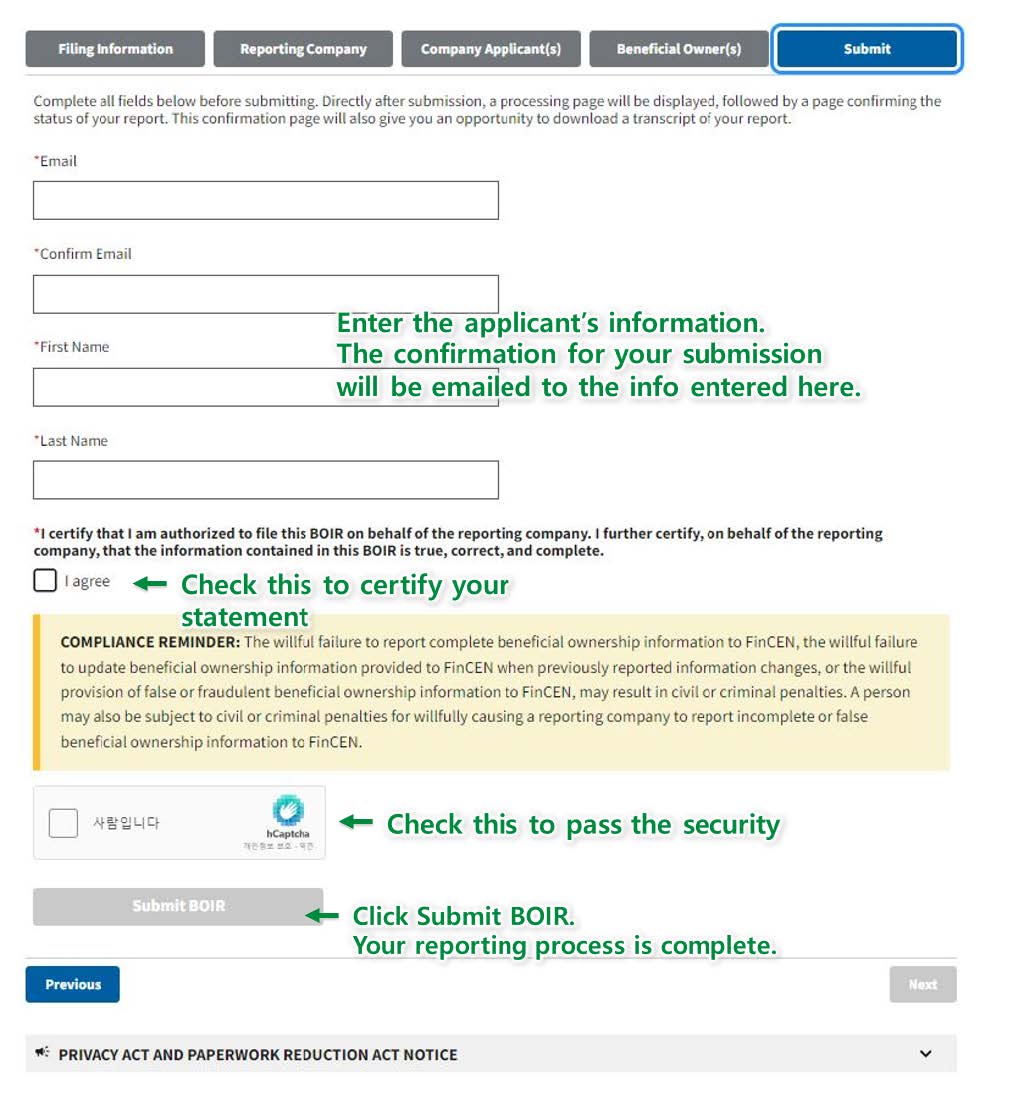

If you need assistance with BOIR filing, our firm can help. Simply reply to this email with your business name and a copy of all owners’ IDs (driver license or passport). Our fee for processing BOIR is $250. If there are more than 4 Beneficial Owners, additional fee of $30 per Owner will be billed.

If you have any questions, please contact us by email info@skjcpa.com or phone (206) 367-6782.

Assistance with BOIR filing

If you need assistance with BOIR filing, our firm can help. Simply reply to this email with your business name and a copy of all owners’ IDs (driver license or passport). Our fee for processing BOIR is $250. If there are more than 4 Beneficial Owners, additional fee of $30 per Owner will be billed.

If you have any questions, please contact us by email info@skjcpa.com or phone (206) 367-6782.

- If you need our firm’s assistance with BOIR filing, refer to the instructions at the end of this message.

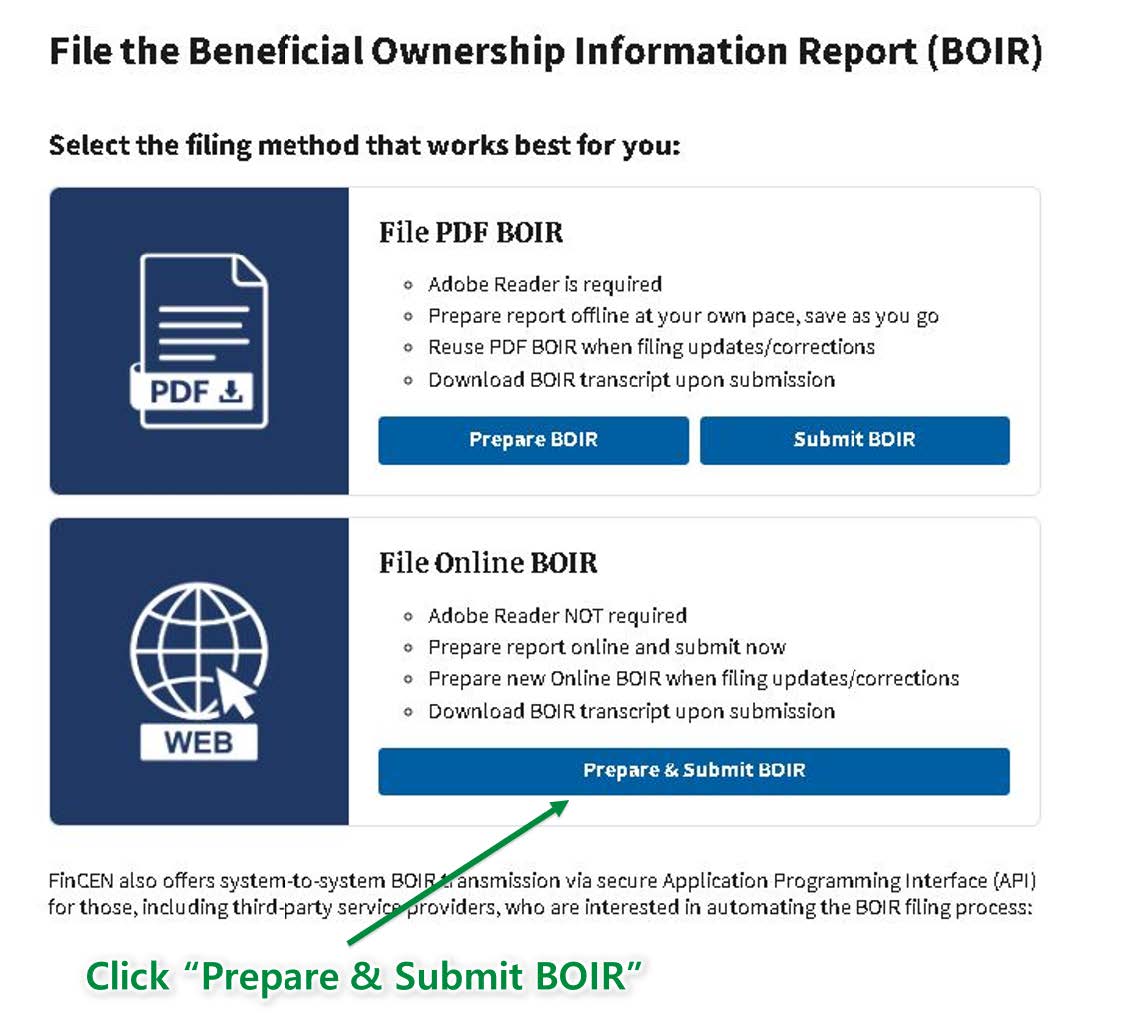

- Many clients are receiving emails and text messages regarding BOIR requirements. Please note, FinCEN never sends mass email or text about the new rules; most of them are advertisement for third-party BOIR filing services. FinCEN does not charge fee for BOIR filing.

- A Control Owner (an individual who has a significant responsibility for controlling, managing or directing the legal entity).

- A person who has 25% or more of the company’s ownership interest.

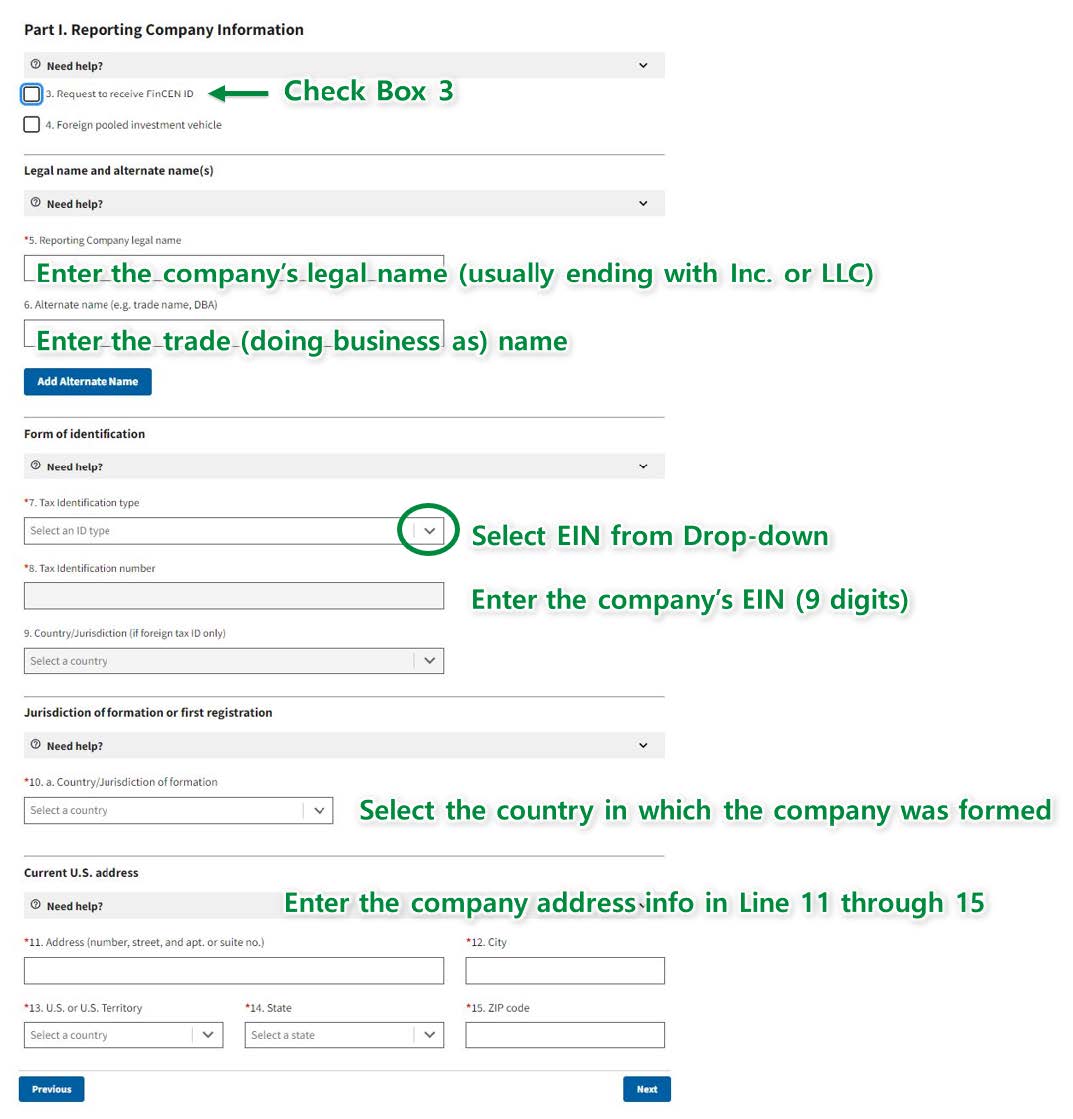

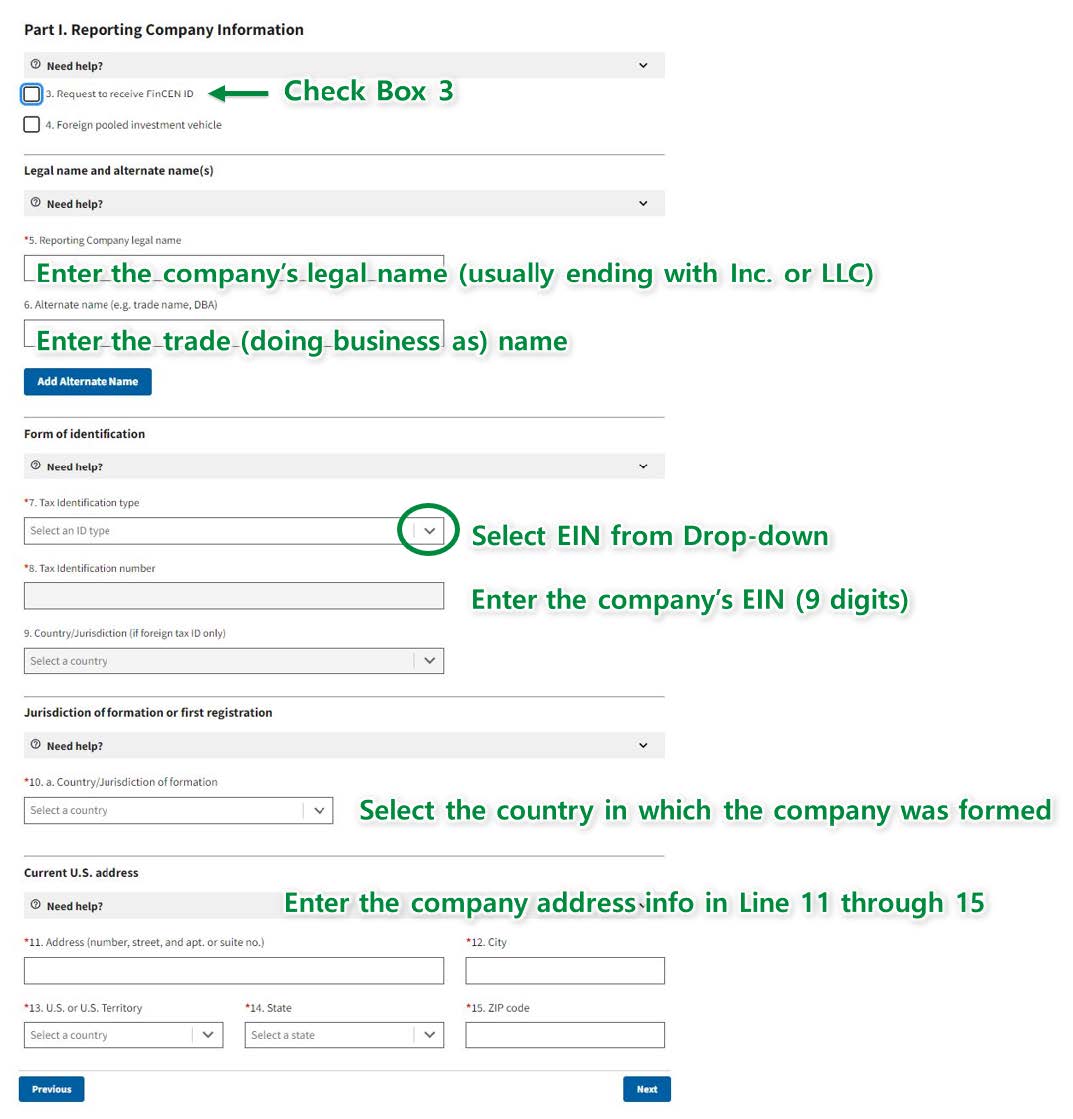

- Legal name of the entity, trade name and address

- Employer Identification Number (EIN)

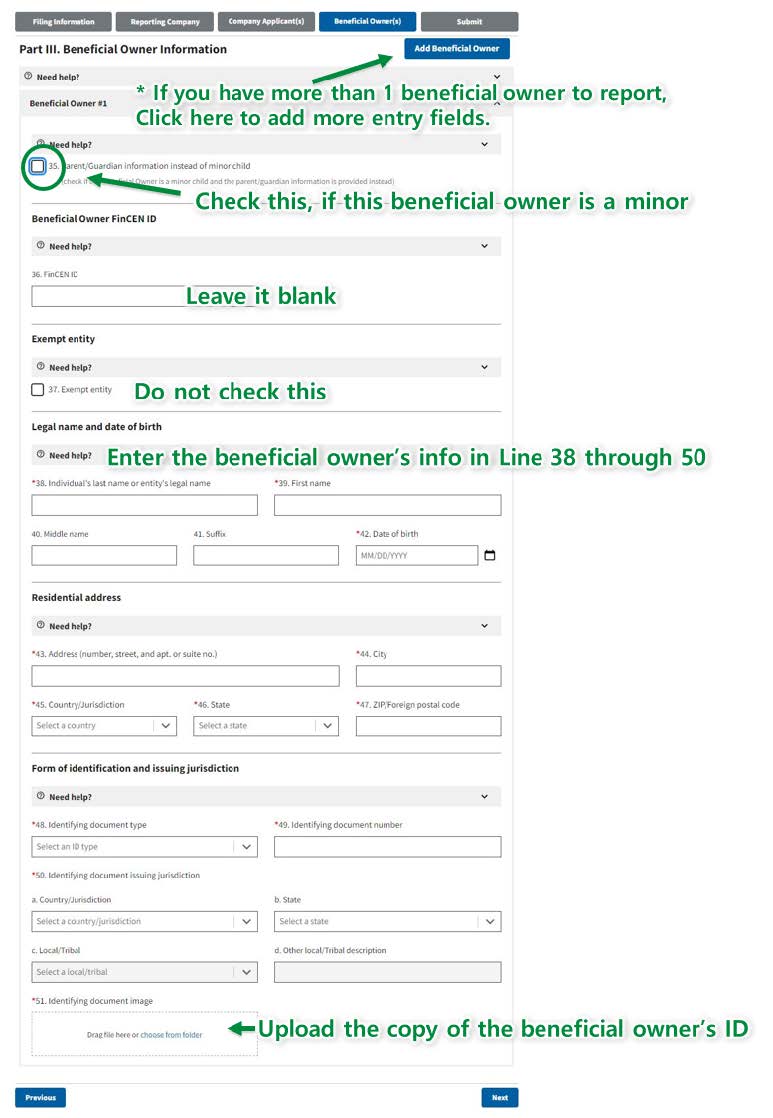

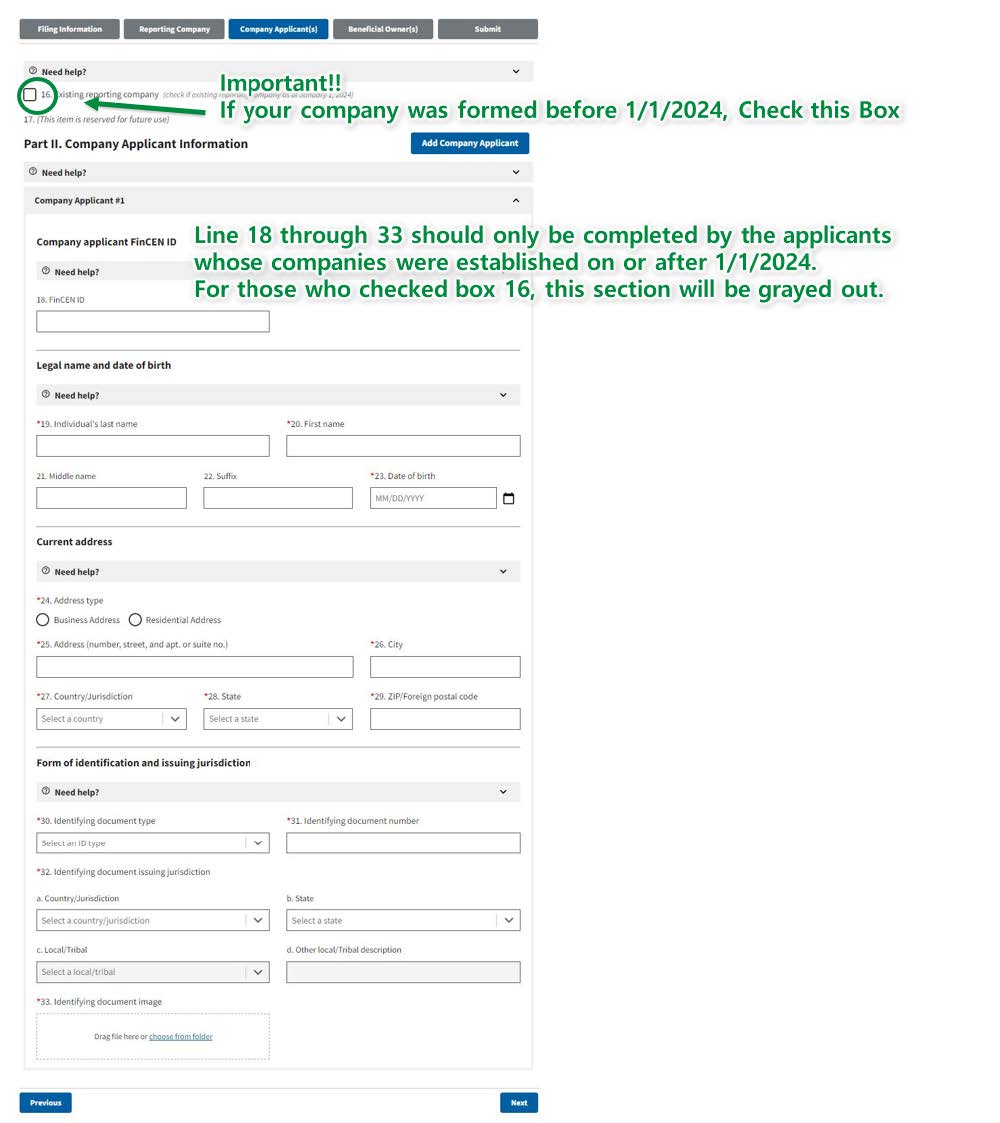

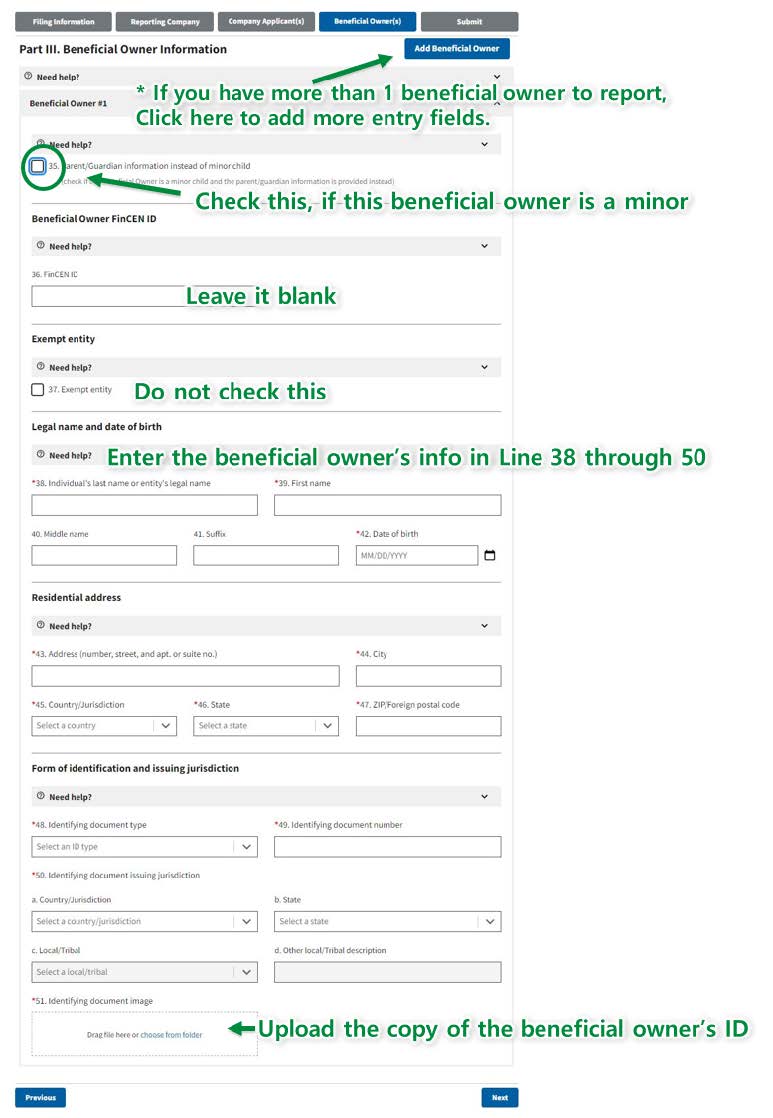

- Beneficial Owner information

- The Owner’s name, address and date of birth

- ID information (i.e. driver license / passport)

- Title in the company

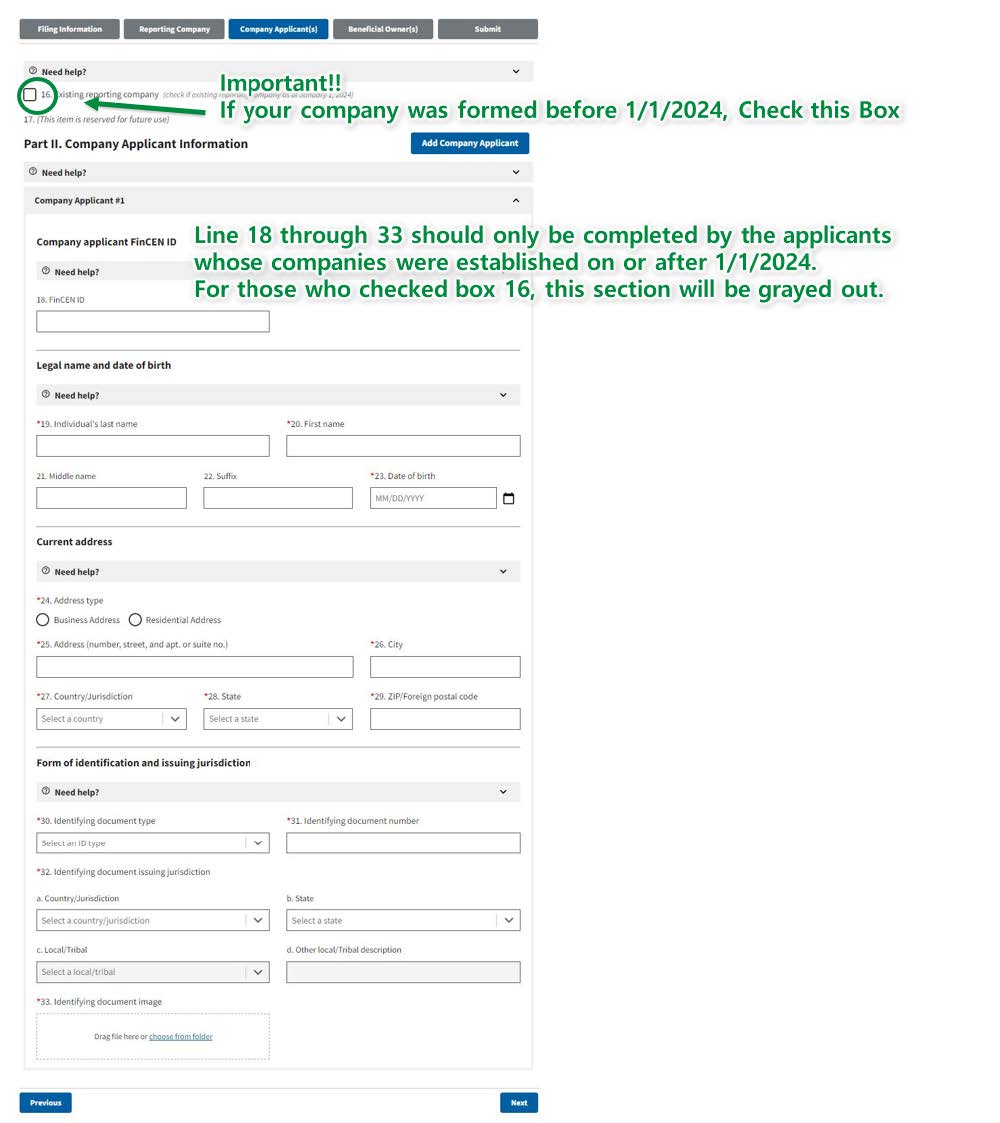

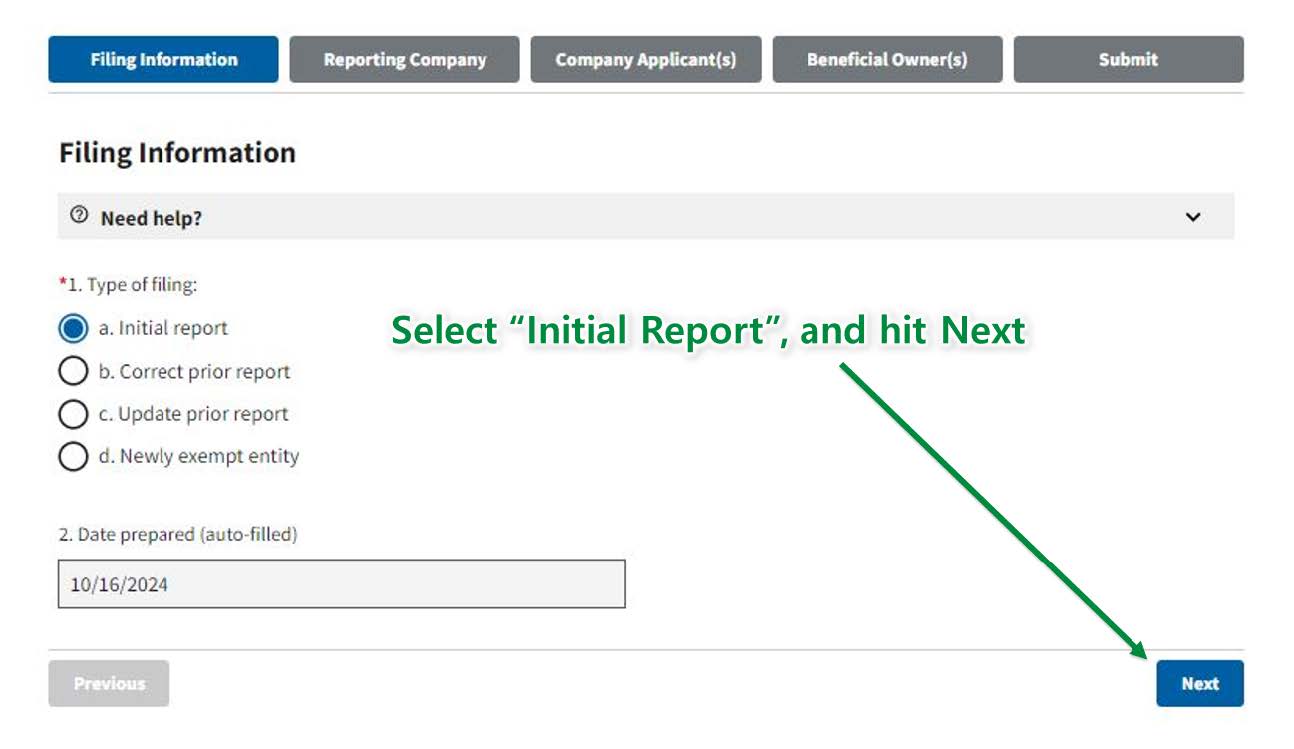

- Companies formed before 1/1/2024 must file BOIR by 1/1/2025.

- Companies formed between 1/1/2024 and 12/31/2024 must file BOIR within 90 days of its formation.

- Companies formed on or after 1/1/2025 must file BOIR within 30 days of its formation.

Assistance with BOIR filing

If you need assistance with BOIR filing, our firm can help. Simply reply to this email with your business name and a copy of all owners’ IDs (driver license or passport). Our fee for processing BOIR is $250. If there are more than 4 Beneficial Owners, additional fee of $30 per Owner will be billed.

If you have any questions, please contact us by email info@skjcpa.com or phone (206) 367-6782.

Assistance with BOIR filing

If you need assistance with BOIR filing, our firm can help. Simply reply to this email with your business name and a copy of all owners’ IDs (driver license or passport). Our fee for processing BOIR is $250. If there are more than 4 Beneficial Owners, additional fee of $30 per Owner will be billed.

If you have any questions, please contact us by email info@skjcpa.com or phone (206) 367-6782.