Dear Clients of SKJ & Company, P.S.:

We are writing to share information with our clients on Paycheck Protection Program loan forgiveness rules and procedures.

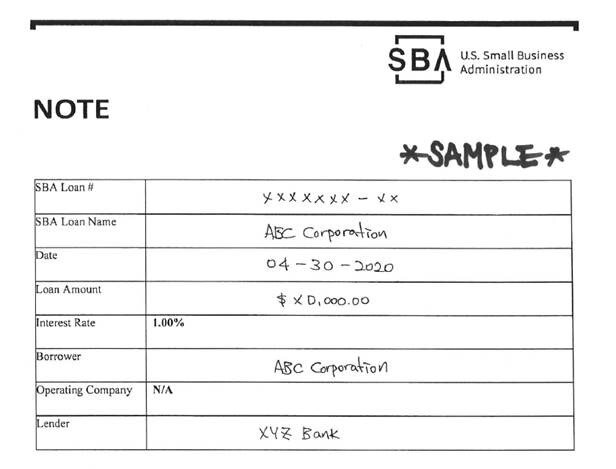

First, below is the sample of SBA PPP loan document which you have received from your lender. If you are requesting our office to prepare the loan forgiveness package, please forward a copy of the loan document to our office. Also, if you receive any email from your lender regarding the PPP forgiveness procedure, please forward the email to info@skjcpa.com.

Below is more information about PPP loan forgiveness:

Due date for PPP forgiveness application is within 10 months from the Covered Period (8 or 24-week) ends.

(e.g.) With loan disbursement date of 5/1/2020, 8-week period ends on 6/26/2020, and due date for Form 3508 is on March 2021.

(e.g.) With loan disbursement date of 5/1/2020, 24-week period ends on 10/16/2020, and due date for Form 3508 is on August 2021.

There are 3 different types of PPP forgiveness application form: Form 3508, Form 3508-EZ & Form 3508-S.

Form 3508-S: For borrowers with loan amount of $50,000 or less.

Form 3508-EZ: For borrowers who are sole proprietors, or who did not reduce employee wage and working hours.

Form 3508: For borrowers who are not eligible for 3508-S or 3508-EZ.

If you sold or closed the business, the due date is within 10 months from the last day of operation.

If you are requesting our office to assist with your PPP forgiveness application:

Please note that our firm will determine:

whether to use 8-week or 24-week period for Covered Period.

which application form applies to you.

when to submit the application depending on your lender.

Our fee for assistance is scheduled as following:

Form 3508-S: $200

Form 3508-EZ: $250

Form 3508: varies, depending on number of employees.

Please let us know if you have any questions. Thank you.

SKJ & Company, P.S.